Pill Text

Pill Text

Pill Text

Pill Text

Almost every major financial decision—whether investing, saving for retirement, or buying property—has tax implications. Yet, today, most financial services providers fail to help users make tax-informed decisions. This gap isn’t accidental; it reflects the complexities of integrating tax capabilities into financial products.

For financial services companies, tax is a notoriously challenging domain. Tax laws are intricate, frequently changing, and require significant regulatory compliance and human capital to navigate. The time and resources required to build and maintain tax-informed systems have historically been barriers to innovation in this space. As a result, users are left to grapple with disconnected financial tools and static tax solutions that don’t adapt to their broader financial picture.

The result? Missed opportunities for users to optimize their financial decisions and for financial services companies to deliver truly integrated, holistic experiences.

How we’ve sustainably built an engine that can be applied to almost any tax problem

At april, we set out to tackle the challenges of building an engine that can solve practically any tax problem or question and be easily integrated into existing products and flows. What sets our engine apart is how it’s built and managed—using two key innovations: collaborative AI and aprilOS, an internal tool that puts tax experts in the drivers’ seat to a new product build.

Collaborative AI for tax logic: The engine leverages a process called tax-to-code, where dense tax regulations are transformed into software code by large language models (LLMs). This automated process generates tax logic from analysis documents, which are then reviewed by tax engineers for accuracy. By reducing manual coding effort, collaborative AI ensures the engine remains highly accurate and adaptable to evolving tax rules.

aprilOS: an internal tool that puts subject matter experts (tax analysts) in control of the front-end tax flow design. With a drag-and-drop editor, tax analysts can build and modify flows—changing questions and logic directly within the interface—without requiring engineering involvement. This streamlined workflow accelerates the integration of new use cases and reduces time to market.

What it enables for financial services

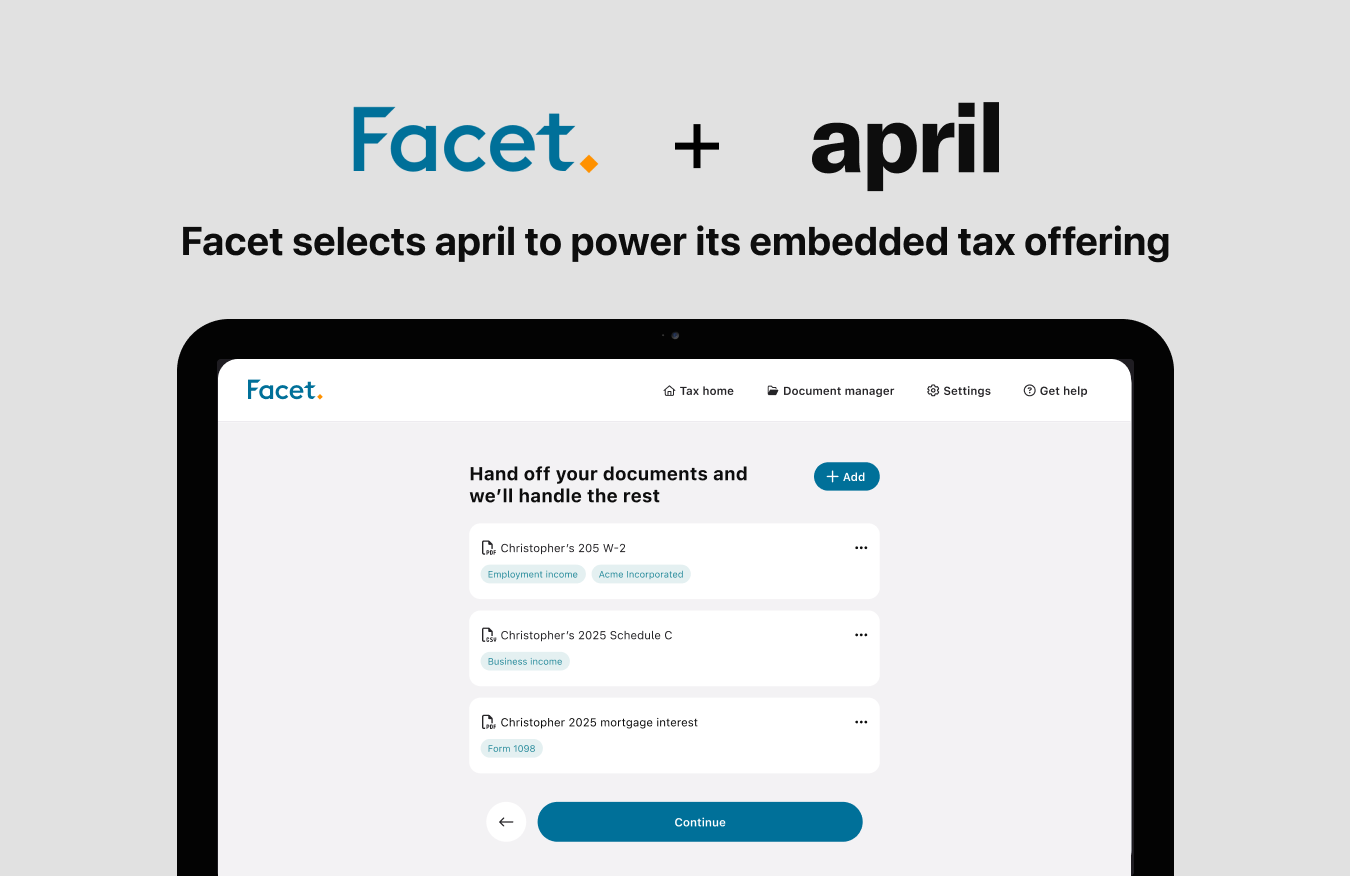

april’s dynamic and powerful tax engine enables financial services providers to seamlessly embed tax capabilities into their workflows, offering smarter, more connected user experiences without the heavy lift of building or maintaining tax systems. By integrating tax-smart tools, companies can unlock significant value for their users. For instance, investment platforms can calculate the tax impact of trades in real time, retirement planning tools can optimize withdrawal strategies based on tax implications, and holistic financial management apps can incorporate tax considerations across savings, income, and investments. This allows providers to deliver differentiated products that stand out in a competitive market while empowering users to make smarter financial decisions with minimal effort. With its adaptability and scalability, april’s tax engine transforms tax complexity into a strategic advantage for financial services providers.

Lessons for building new technology in complex domains

april’s approach to building aprilOS offers valuable insights for companies navigating highly regulated or dynamic domains. A key takeaway is the importance of collaborative AI—not as a replacement but as an enabler. By combining automated processes with expert oversight, systems can achieve both scalability and trustworthiness. aprilOS leverages this approach to transform complex tax regulations into actionable workflows, ensuring accuracy while reducing manual effort.

Another crucial lesson is the value of empowering experts through internal tooling. Tools like aprilOS put subject matter experts, rather than engineers, at the center of product design. This not only accelerates time-to-market but also allows teams to innovate by focusing on their core expertise.

Finally, successful systems must prioritize integration. The future of financial services lies in embedded solutions that enhance existing workflows without significant investment. april isn’t building standalone tax solutions; instead, it’s enabling companies to seamlessly integrate tax expertise into their products, unlocking new value for their users with minimal effort.

At april, we’re not just solving tax challenges—we’re laying the groundwork for a smarter, more connected future in financial services and beyond.

Related Content

Related Content

Related Content

Related Content

There's more where this came from